Cardin, Portman Reintroduce Tax Credit to Encourage Revitalization of Distressed Homes U S. Senator Ben Cardin

Table of Content

These included Edward Little Rogers, who designed a series of Aberdeen houses for his own use, before relocating in New York City. Other resident architects included William H. Andrews, who lived at 22 Sutherland Road and Edward H. Hoyt who resided at 24 Cummings Road. At 89 Englewood Avenue stands one of the oldest of the neighborhood’s large-scale residences, an elaborate brick Queen Anne style mansion, built in the late 1880s for roofing contractor Frank W. Krogman.

Senators Ben Cardin (D-Md.) and Rob Portman (R-Ohio), both members of the Senate Finance Committee, have introduced legislation (S. 98) to revitalize housing in distressed neighborhoods in Maryland, Ohio and nationwide. The Neighborhood Homes Investment Act creates a federal tax credit that covers the cost between building or renovating a home in these areas and the price at which they can be sold. The NHIA would also help existing homeowners in these neighborhoods to renovate and stay in their homes.

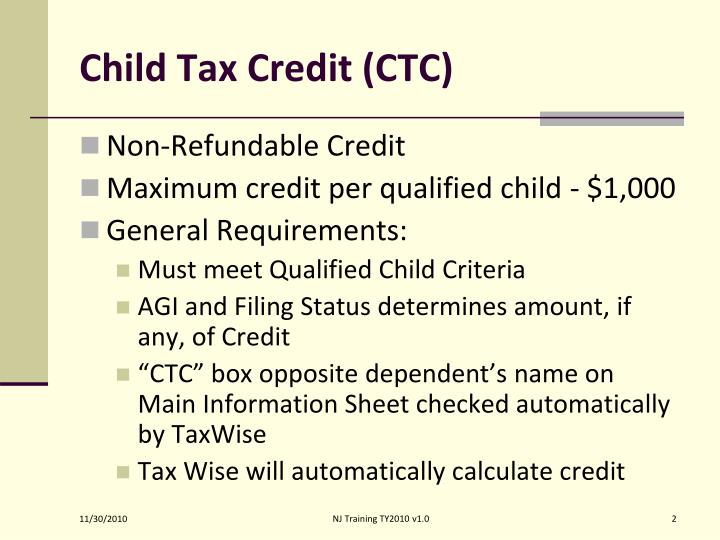

Changes that affect your tax credits

Sign The American Property Owners Alliance petition to Congress urging them to support property owners and remove barriers to more affordable housing. In addition, homes must be located in areas where there is a poverty rate of at least 130% of the area poverty rate, the median family income is below 80% of the area median, and median home values are lower than the area median in order to be eligible for the credit. The White House indicated that would cover approximately 25% of all census tracts. The goal of the Neighborhood Homes Investment Act is to create a financing tool for single-family housing, as powerful as Low-Income Housing Tax Credit , to help transform neighborhoods across the country. Department of the Treasury and Internal Revenue Service, members of Congress and other federal and state agencies. The Olmsted firm had also been hired by the City of Boston to devise a plan for a grand avenue in the eastern part of Brighton that would link lower Commonwealth Avenue to the Chestnut Hill Reservoir.

The Aberdeen section of Brighton, which lies just outside of Cleveland Circle, contains some of the finest turn-of-the-century architecture in the City of Boston. Unfortunately, this unique concentration of high-style Medieval Revival, Queen Anne, Shingle, and Colonial Revival edifices has experienced a steady erosion in recent years at the hands of insensitive developers and absentee landlords. The reforms build on the findings in the report of the independent Commission on Local Tax Reform, in which the Commission said that to make a property tax fair, it would need to be more progressive and include extensive income-based relief based on households' ability to pay.

How council tax works

Because the city dragged its feet on this project, it was not carried into effect until the early 1890s. Once completed, however, electric streetcar service was also installed along this second grand boulevard, Commonwealth Avenue. Thus, by the late 1890s, two major avenues, both serviced by electric streetcar lines, ran along the periphery of the Aberdeen section. The reforms address the inherent unfairness of the original council tax system, which determined that lower-banded properties paid more as a proportion of property value than households in the higher valuation bands. By the end of financial year 2018 to 2019, we will have invested more than £1.4 billion in CTR. In 2017, we extended the CTR scheme to deliver greater relief to households with children, and to provide relief for low to middle income households from the impact of the council tax reforms on properties in bands E - H.

Racial inequity- The lack of capital for reinvestment in low- and moderate-income neighborhoods has exacerbated racial inequities, in particular, the great disparity between African American family wealth and the family wealth of every other ethnic and racial group in America. As reinvestment-starved neighborhoods continue to decline, so do the assets of the families that own property within them. Discovering how the Neighborhood Homes TC Credit can be combined with various community development tax and other incentives to achieve the maximum benefit for eligible households and distressed communities. Councils have discretion to vary the council tax payable on unoccupied properties. Initially a discount of between 10% and 50% is required, but after a property is unoccupied for 12 months , an increase of up to 100% may be imposed to encourage owners to bring empty homes back into use. You can claim extra tax credits to help with your childcare costs if you're eligible.

$4.25 billion of total development activity

Electric streetcars, by contrast, began operating at 6 a.m., and ran at convenient 10 minute intervals during the busiest hours of the day. In 1886 the greatest impediment to development was removed when Henry M. Whitney, the President of the West End Street Railway Company, and a major owner of Beacon Street real estate, hired renowned landscape architect Frederick Law Olmsted, to widen and improve that thoroughfare. Over the next two years, Olmsted replaced the rough country lane with a spectacular 160 foot wide paved Parisian style avenue. Many young people leaving care require support to manage the effects of their pre-care and in-care experiences as they make the transition into adulthood and independent living.

It is understandable that potential commuters had little wish to locate near such facilities. Another odiferous slaughterhouse, belonging to Joseph L. White, stood near the entrance of the present Beacon Street MBTA car barns, opposite the Ground Round Restaurant in Cleveland Circle. The largest business in Brighton at the time of the Civil War [Curtis & Boynton] employed from thirty to fifty men and required a stable of about 25 work horses to do the trucking with frequent employment for hired teams.

Click here for a simple visual description of NHIA in action

Sponsors would use the tax credits to raise equity capital from investors and oversee the development and marketing of the homes. Investors – not the federal government – would assume construction and marketing risk. Investors would receive tax credits only after the construction or rehabilitation work is completed and the property is occupied by an eligible homeowner. “The Neighborhood Homes Investment Act will help address the housing affordability crisis, create jobs, and encourage economic development during these tough times.

One of its largest stockholders was Henry M. Whitney, the transportation mogul who had developed Beacon Street. Others included G.T.W. Braman, President of the Boston Water Power Company; Noah W. Jordan, President and Chairman of the Board of the American Loan & Trust Company; and Isaac T. Burr, President of the Bank of North America. Two of the largest stockholders, incidentally, were Brighton men, George A. Wilson and Benjamin F. Ricker. As prior owners of land in the area, they probably traded their acreage for Aberdeen Land Company stock. One must bear in mind that the area was quite remote from the downtown at this stage.

The Council Tax Reduction Review Panel can independently review and hear appeals against local authority decisions relating to relief provided by the means-tested council tax reduction scheme. The credit would make up the difference between the costs of the rehabilitation and development, and the eventual sales price. However, there would be a cap on the final sales price that could not exceed four times the area median family income.

Our means-tested Council Tax Reduction scheme reduces or eliminates the council tax liability of around 500,000 lower income households in Scotland, depending on household circumstances and ability to pay. Each of the 14 local Scottish Assessors is responsible for valuing properties for Council Tax purposes in the local authority district they serve. They assign each property in Scotland one of eight valuation bands, from A to H , based on its relative property value. Investors, not the government, bear the risk – credits would be received only after rehabilitation is completed and the property is occupied by an eligible homeowner. The Treasury Department is required to provide an annual report on the performance of the program. Please visit the website to get more information about this exciting housing tax credit policy proposal.

March 28, 2017 I was asked to keep an open mind and participate in a progressive conversation that thinks differently about neighborhood revitalization and tax credits. Recently, the White House proposed a new tax policy that could be very advantageous for real estate investors. As part of his trillion-dollar infrastructure package, President Biden has officially announced theNeighborhood Homes Tax Creditto spur the development and rehabilitation of affordable homes. The neighborhood derived its name from the Aberdeen Land Company, which was founded in 1890. The company’s stock was held by twenty five investors, mostly Boston area financiers, merchants, and manufacturers. It was chartered to operate until 1915, for the express purpose of developing the area residentially.

Comments

Post a Comment